-

November 19, 2019 News Employment Alerts

The Chicago City Council recently passed the Fair Workweek Ordinance, the most sweeping “predictive scheduling” ordinance in the country. The Fair Workweek Ordinance aims to give hourly workers more predictable schedules and stable paychecks by mandating that employers give workers early notice of their schedules or face financial penalties if they change shifts unexpectedly. Additionally, the Ordinance requires employers needing to fill additional shifts to first offer those hours to covered employees.

Read More -

November 19, 2019 News Employment AlertsEmployment Law

Illinois has also passed a new law, which goes into effect on January 1, 2020, aimed at employers who use artificial intelligence during their recruiting process for new hires.

Read More -

November 19, 2019 News IP AlertsIntellectual Property

But the United States Patent and Trademark Office (“USPTO”) didn’t quite keep up. The USPTO would routinely reject any trademark it considered scandalous, disparaging, immoral or offensive.

Read More -

November 19, 2019 News

Golan Christie Taglia is built on a foundation of professional excellence and outstanding service. Each member of our team is committed to excellence and dedicated to achieving success for our clients. It is always gratifying when one of our own is recognized as exceptional, and we are pleased to share some recent accolades. Earlier this year, Leading Lawyers named 24 Golan Christie Taglia attorneys as Leading and Emerging Lawyers in Illinois for 2019, three of which (in bold) are new additions to the lists.

Read More -

November 19, 2019 News

DAVID M. SALTIEL was named Best Lawyers’ 2020 Lawyer of the Year in the practice area of Entertainment Law—Motion Pictures and Television in Chicago. This is the third time that David has been recognized as Lawyer of the Year.

Read More -

November 19, 2019 News

Our commitment to service extends into our communities, as well. GCT attorneys serve on a wide range of charitable organization boards and volunteer time and resources to many worthy causes. During KATHERINE M. OSWALD’s term as a Chicago Bar Association (CBA) Young Lawyers Section (YLS) executive board member, the CBA YLS received Awards of Achievement from the American Bar Association in six categories.

Read More -

November 19, 2019 Newsletters

- New Illinois Law Significantly Changes Sexual Harassment Rules And Employer Responsibilities

- What You Need To Know About Chicago’s Fair Workweek Ordinance And Illinois’ Artificial Intelligence Video Interview Act

- How Standards Of Morality May Affect Your Trademark Decisions

- GCT Attorneys Recognized For Commitment To Professional Excellence As The GCT Family Continues To Grow

-

October 17, 2019 EventsGolan Christie Taglia, 70 West Madison Street, Suite 1500, Chicago, Il 60602Intellectual Property

Please join Golan Christie Taglia Partner Beverly A. Berneman for an informative Lunch & Learn to demystify common intellectual property myths that could put you and your business at risk.

Read More -

September 19, 2019 EventsGolan Christie Taglia 70 West Madison Street Suite 1500 Chicago, Il 60602Employment Law

EEO-1 reports must be filed by September 30, 2019. This year, there is a significant change in the employer’s responsibility. The EEOC is requesting information about employees’ pay and hours worked, broken down by race, sex and ethnicity, from 2018 and 2017 payrolls.

Read More -

September 10, 2019 NewsProperty Tax Assessment

As a result of the unprecedented assessment increases to commercial and industrial property values in Cook County, how will lenders deal with the resulting impact on their borrowers' tax liabilities?

Read More -

September 10, 2019 Property Tax Insights

As a result of the unprecedented assessment increases to commercial and industrial property values in Cook County, how will lenders deal with the resulting impact on their borrowers' tax liabilities? How will they respond to borrowers who claim they cannot meet their lender's call for substantial upward adjustments in their tax escrows? With regard to income producing properties, what happens when loan to value ratios change due to the decline in market values resulting from the affect of additional property tax expenses on the borrower's NOI. A $50,000 increase in property tax expenses, capped at 7%, could diminish the market value of a property by more than $700,000. It's not always that simple, but a decline in market value is the logical consequence of a higher tax bill for both owner/occupants and landlords. And that leads to an additional line of inquiry as to how tenants, and prospective tenants, will respond to a significant increase in their overall rent coming from these potential increases in their property tax liabilities? Will it, or has it already, caused a slow down in both leasing and sales activity? Will prospective tenants, as well as prospective purchasers and lenders, be taking a more cautious approach to making their final decisions going forward? How will lenders ultimately respond to their increased risk as existing loan to value ratios begin to fluctuate? The typical response would be for them to adjust interest rates upward where possible, to account for the sudden increase in risk, and to work to get their loan to value ratios back in synch. How they choose to accomplish this could have significant consequences for the real estate market.

Read More -

September 8, 2019 EventsScotiabank Convention Centre, 6815 Stanley Ave, Niagara Falls, CanadaProperty Tax Assessment

Please join Golan Christie Taglia attorney James W. Chipman for his presentation at the 85th Annual International Conference on Assessment Administration to be held in Niagara Falls, Ontario on Tuesday, September 10, 2019 at 10:45 a.m.

Read More -

September 4, 2019 NewsProperty Tax Assessment

New Trier Township is located in Cook County, IL. The entire township was subject to a reassessment in 2019. The Assessor opened the township for appeals on April 29 2019. The Assessor then certified the final assessments for all real estate in the township on August 15, 2019, meaning that he had completed his work for the year and closed his books.

Read More -

September 4, 2019 Property Tax Insights

New Trier Township is located in Cook County, IL. The entire township was subject to a reassessment in 2019. The Assessor opened the township for appeals on April 29 2019. The Assessor then certified the final assessments for all real estate in the township on August 15, 2019, meaning that he had completed his work for the year and closed his books.

Read More -

August 22, 2019 NewsProperty Tax Assessment

The Assessor proposed a 2019 market value of approximately $1,744,000 for a property. The party purchased the property for approximately $1,150,000 at the end of 2018 in an arm's length, brokered transaction. The evidence tendered in support of the appeal included the following documents:

Read More -

August 22, 2019 Property Tax Insights

The Assessor proposed a 2019 market value of approximately $1,744,000 for a property. The party purchased the property for approximately $1,150,000 at the end of 2018 in an arm's length, brokered transaction. The evidence tendered in support of the appeal included the following documents:

Read More -

July 25, 2019 EventsWebinar 12:00pm - 1:00pm CST Followed by Q&A

Ways employers can maintain a compliant 401(k) plan and be proactively prepared to defend their practices.

Read More -

July 8, 2019 NewsProperty Tax Assessment

The Cook County Assessor continues his relentless vendetta against business properties in north suburban Cook County. Unprecedented assessment increases upward of 200-300% are being mailed to unsuspecting taxpayers.

Read More -

July 8, 2019 Property Tax Insights

The Cook County Assessor continues his relentless vendetta against business properties in north suburban Cook County. Unprecedented assessment increases upward of 200-300% are being mailed to unsuspecting taxpayers. Every property is being treated as institutional grade investment property, from mom and pop storefronts to small apartment buildings. The assumption that all properties are being leased on a triple net basis allows the Assessor to eliminate property taxes as an expense, which results in higher net incomes and allows the use of much lower capitalization rates. These low rates only allow for a return of the investment necessary to cover debt service, not a return on the investment which allows a return on owner equity. This practice is being used to greatly increase the market value of virtually every commercial and industrial property in the north and northwest suburbs. While claiming complete transparency, Freedom of Information Requests filed on behalf of taxpayers by their attorneys to determine the reason for a denial of relief, are taking upwards of 6 weeks to process, while the law requires a response in not more than 10-days. When responses do become available, a review indicates how the Assessor is manipulating data to ensure that virtually every appeal will be denied. The good news is that the Board of Review has opened a month early, in anticipation of a huge increase in the volume of appeals due to the Assessor's refusal to grant relief, even on the most meritorious cases. The Board has also disclosed that it will continue to review cases as it always has, and will grant relief on the merits of each case, without a pre-determined policy intended to find any means to deny relief to property taxpayers who could see their tax bills skyrocket due the Assessor's failure to act in a fair and equitable manner.

Read More -

July 2, 2019 News PRESS

Chicago, IL - Golan Christie Taglia, LLP filed a complaint today in the Circuit Court of Cook County, Illinois alleging breach of contract on behalf of Teepu Siddique, MD, faculty member of Northwestern University Feinberg School of Medicine.

Read More -

June 24, 2019 Newsletters

- New Federal Tax Laws Amend Deductibility Of Government Fines

- New EEO-1 Reporting Requirements And Salary History Ban

- What You Should Know About Amazon’s Brand Registry

- GCT Attorneys Recognized And Honored

-

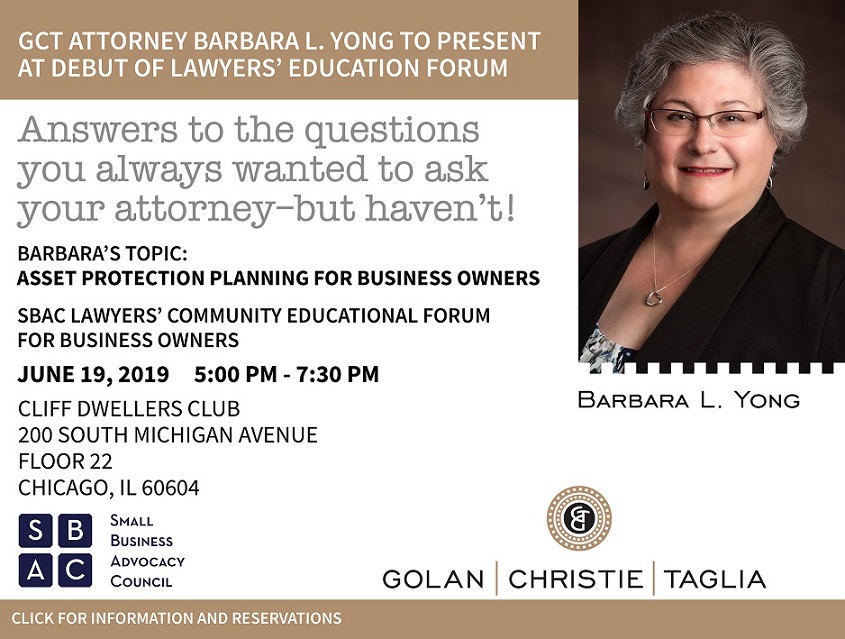

June 19, 2019 EventsCliff Dwellers Club, 200 South Michigan Avenue, Floor 22, Chicago, IL 60604Commercial & Business Litigation, Employment Law, Intellectual Property

Please join Golan Christie Taglia attorney, Barbara L Yong, at the SBAC Lawyers’ Community Educational Forum for Business Owners for her presentation regarding asset protection planning for business owners.

Read More -

May 3, 2019 NewsProperty Tax Assessment

Has the value of your business property actually increased by 82% in just 3-years?

Read More -

May 3, 2019 Property Tax Insights

Has the value of your business property actually increased by 82% in just 3-years?

Read More -

April 24, 2019 NewsProperty Tax Assessment

In the first three townships having a significant commercial and/or industrial tax base, (Norwood Park, Evanston and Elk Grove, the new assessor has been increasing market values by as much 50 to 300%. He claims that properties in the northern suburbs have been grossly underassessed for years, hence a 1-year catch-up was justified.

Read More