"Businesses can use Chapter 11 to reorganize or liquidate. Chapter 11 is a reorganization proceeding, also under the supervision of the Bankruptcy Court, but typically with the debtor continuing to run the business."

"It is possible for struggling and cash-strapped businesses to change their business model, obtain new financing, restructure existing debt and negotiate payment plans with their creditors without filing a bankruptcy."

BANKRUPTCY UPDATE

Chapter 11 as a Remedy for Businesses in Financial Crisis

March 1, 2015

Owners of businesses that are insolvent, regardless of whether the insolvency is determined using the balance sheet test (meaning their liabilities exceed their assets) or because they are unable to pay their debts as they come due, need to act responsibly to prevent creditors from imposing personal liability for business debts. Once a business is insolvent, the owners have a fiduciary duty to act in the best interest of their creditors to either turn the business around and make it profitable or to shut it down to prevent a deepening insolvency on the backs of the creditors.

Businesses can use Chapter 11 to reorganize or liquidate. Chapter 11 is a reorganization proceeding, also under the supervision of the Bankruptcy Court, but typically with the debtor continuing to run the business. Chapter 11 debtors are usually larger companies (though we now know none are “too big to fail,”) or wealthy individuals, in part because of the complexity and expense of the Chapter 11 process itself.

BENEFITS OF CHAPTER 11

- Immediately upon filing, the debtor is entitled to the protections of the automatic stay. This prevents creditors from taking any action to collect their debts. It puts alllitigation on hold and can prevent a lender from proceeding with a foreclosure of its mortgage or a UCC sale of business assets. This provides a small business a little bit of breathing room.

- The debtor can also reject unfavorable contracts like leases or rental agreements. This allows a small business to close locations and get relief from above-market rent.

- The debtor can also borrow new money through a debtor-in-possession or DIP loan, and give the lender a super-priority lien, which puts them ahead of the business’ existing lenders.

- Debtors can also sell some or all of their assets (including real estate, machinery and equipment, vehicles, and even intellectual property) free and clear of liens and claims, with the liens attaching to the proceeds of the sale.

- Debtors can also renegotiate terms of their collective bargaining agreements, provided the negotiations are conducted in good faith.

- The debtor also gets a reprieve from paying its pre-bankruptcy debts while it is in Chapter 11. During this time, the debtor can accumulate a surplus to help strengthen the business after bankruptcy.

- Finally, debtors can pay their pre-bankruptcy debt over time through a plan. Certain claims like taxes, which are given priority, will need to be paid in full. For most claims, however, a fraction of the amount owed can be paid on a pro rata basis over several years. Business debtors do not, however, receive a discharge.

Can some or all of this be done outside of a bankruptcy? No - these protections only exist in bankruptcy.

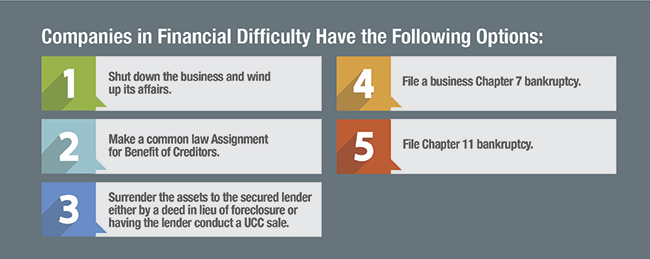

Is Chapter 11 the answer for every small business that either can’t afford to pay its creditors or finds itself upside down? No, but it should be considered, along with the other less costly options. These options should be discussed with experienced bankruptcy counsel. It is especially important if the business is continuing to lose money and can only survive by increasing the debts to its trade creditors or failing to pay payroll taxes, both of which can subject the business owner to personal liability.

It is possible for struggling and cash-strapped businesses to change their business model, obtain new financing, restructure existing debt and negotiate payment plans with their creditors without filing a bankruptcy. But when all else fails, Chapter 11 should at least be considered as an option before shutting the doors.

While Chapter 11 is expensive, the costs can be quite reasonable compared to the valuable benefits Chapter 11 can provide, not to mention the huge amount of debt which can be eliminated from a small business’ bottom line.

Contact Barbara Yong, (312)696.2034, or blyong@golanchristie.com if and when your business is in financial difficulty to review the options. There is no charge for her initial consultations.