"The exemption from the federal gift tax has never been higher. In 2012, an individual can give away as much as $5,120,000 ($10,240,000 per married couple) without paying federal gift taxes.”

GIFT TAX UPDATE

Is it Better to Give than to Receive?

September 1, 2012

Is it better to give than to receive? Purely from a tax perspective, the answer is generally no, since the person giving the gift may be subject to a federal gift tax, while the recipient generally is not.

Hotly debated both before and since its passage in 2010, there likely will be more legal challenges, rules, and regulations before most of ObamaCare’s requirements for employers take effect in 2014. But as the law stands now, the significant obligations for employers under ObamaCare are summarized below.

Federal Gift Tax Exemption has Never Been Higher

The exemption from the federal gift tax has never been higher. In 2012, an individual can give away as much as $5,120,000 ($10,240,000 per married couple) without paying federal gift taxes. It should be noted that the exemption is reduced by prior lifetime taxable gifts. The increased generation-skipping transfer (“GST”) tax exemption permits these gifts to benefit grandchildren and more remote descendants. This tax exemption for lifetime gifts is in addition to the annual gift tax exclusion that covers gifts of up to $13,000 ($26,000 per married couple) per recipient per year, as well as the exclusion for certain

Unique Gifting Opportunity in 2012

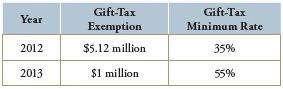

The gift tax exemption is slated to decrease to its traditional level of $1 million at midnight on December 31, 2012. In addition, the gift tax rates will increase from 35% to a maximum of 55%, as illustrated below:

The impact of this change is that an individual can make a large gift in 2012 without incurring any gift tax, while the same gift made in 2013 (or any subsequent year) will result in a significant gift tax liability.

Benefits of Making Gifts in 2012

Making a sizable gift in 2012 has several benefits. First, a gift in 2012 represents what could be a onetime opportunity to transfer wealth to children or other beneficiaries without paying a gift tax and to accomplish multi-generational planning without paying any GST tax. Second, these gifts can save estate taxes by removing the future appreciation on and income from the gifted asset from an individual’s estate. Finally, the value of some gifted assets, specifically minority interests in closely held businesses, can be discounted for gift tax purposes.

Prior to making these gifts, you should consider a number of factors, including lifestyle choices, realistic future cash flow needs, what assets should be given, the impact the gift will have on the recipients, and incorporation of the gift into your overall estate plan.

Three Months Left

Proper planning takes time, since your professional team needs to create a well thought out gifting strategy, draft the necessary documents, and implement the plan. Moreover, if you are considering making a gift of a business interest or an interest in real estate, additional time is needed to obtain a qualified appraisal of the interest. If you or your family members are contemplating gifting to take advantage of this unique window of opportunity, please contact us. Even if you don’t feel that you are in a position to make a large gift at this time, we would be happy to speak with you about the advantages of making gifts as part of your comprehensive estate planning.

Contact Donna F. Hartl, Barry P. Siegal or Nancy Franks-Straus to discuss gifting and other estate planning strategies that could benefit you.