FROM OUR MANAGING PARTNER

HOW THE BROAD SCOPE OF THE SECURE ACT WILL AFFECT RETIREMENT PLANS

READ MORE

THE CHALLENGES MARIJUANA BUSINESSES FACE CHOOSING AND PROTECTING TRADEMARKS

READ MORE

A STREAMLINED CHAPTER 11 BANKRUPTCY PROCESS FOR SMALL BUSINESSES

READ MORE

HOW CANNABIS LAW AMENDMENT AND A RECENT APPELLATE COURT DECISION MAY AFFECT EMPLOYERS

READ MORE

GCT ATTORNEYS RECOGNIZED FOR PROFESSIONAL EXCELLENCE

READ MORE

We at Golan Christie Taglia strive earnestly to demonstrate our ongoing commitment to you and we value the confidence you have placed in us. As we await the arrival of Spring, please know that our mission continues to be your success.

Stephen L. Golan

FOCUS: Trust, Estate & Taxation & Not-For-Profits

SECURE ACT ALTERS 401(K) COMPLIANCE LANDSCAPE

THE SECURE ACT ENACTS SWEEPING CHANGES TO RETIREMENT PLANS

In order to encourage employers to: (a) offer tax-qualified retirement plans to their employees; and (b) make IRA contributions more beneficial to individuals, Congress passed, and the President signed into law, the Setting Every Community Up For Retirement Enhancement Act of 2019 (the “SECURE Act”). Some of the major provisions of the Act and how they change current law are set forth below.

CHANGES AFFECTING 401(K) PLANS

Many employers have established 401(k) plans that allow certain qualified employees to set aside a portion of their compensation on a pre-tax basis into a savings plan, which continues to grow on a tax-free basis until the funds are withdrawn by the employee participant. In many cases, the participant’s contributions are matched, at least to some degree, by the employer.

The benefits of these plans have been increased:

- by allowing businesses to provide for part-time employees over the age of 21 (500 hours per year or more) to participate in the plan. Previously, an employee had to work 1,000 hours a year to qualify.

- by providing a sponsoring employer with a credit of 50% of start-up costs up to a maximum of $5,000 (previously $500). An additional $500 annual credit (up to three years) can be taken if the plan provides for an automatic enrollment feature into a 401(k) or SIMPLE IRA plan.

- by allowing multi-employer 401(k) plans that help pool the cost of administering a retirement plan among multiple employers and providing features that would otherwise be unfeasible.

- by making it easier for small businesses to include an annuity feature in the plan, whereby a participant can elect to receive retirements in equal installments during his or her lifetime computed on the basis of the participant’s life expectancy. Employers should be cautioned to consult with their financial advisor before incorporating this type of provision.

- by allowing a withdrawal of up to $5,000 from a retirement plan without penalty for individuals after the birth or adoption of a child. The participant may also elect to repay the withdrawn amount without penalty as well.

CHANGES AFFECTING IRAS

The SECURE Act also attempts to incentivize individuals to maximize contributions to IRAs:

- by permitting individuals to make contributions to a traditional IRA without any age limit (currently, individuals can make contributions only until age 70½).

- by increasing the age at which withdrawals from an IRA must be taken to avoid a penalty (50% of the required distribution) from 70½ to 72.

- by allowing the same withdrawal amount ($5,000) as described above for a newborn or adopted child.

- by modifying the definition of “compensation” to allow individuals in pursuit of graduate or post-doctoral studies or research (such as fellowships, stipends, or similar amounts) to treat any such amounts received as compensation for purposes of making IRA contributions.

The provisions of the SECURE Act continue a trend in retirement legislation, that began in 1974 with the enactment of the Employment Retirement Income Security Act of 1974 (“ERISA”), to reduce employers’ administrative and fiduciary burdens of providing a retirement plan for a maximum number of employees.

Although most IRA owners and 401(k) plan participants will benefit significantly from contributing toward their retirement through IRAs or 401(k) plans, Congress found it necessary to make the Act revenue neutral. In order to do so, the Act eliminates the current rules that allow non-spouse IRA beneficiaries to “stretch” required minimum distributions (“RMDs”) from an inherited account over their lifetime. Instead, all funds from an inherited IRA or inherited 401(k) account generally must be paid to non-spouse beneficiaries within 10 years of the IRA owner’s death.

The overall takeaway from this recent legislation appears to be that individuals who either participate in company-sponsored plans or IRAs should be aware that the already generous incentives to contribute to these plans, such as tax-deductible contributions, tax-free build-up while the accounts are growing and sometime tax beneficial treatment when funds are withdrawn, are increased by the SECURE Act. As always, you are encouraged to seek financial advice from professionals before changing your course of action, especially in naming beneficiaries of these plans.

If you have questions or need additional information, please contact an attorney at Golan Christie Taglia, LLP.

WEEDING OUT TRADEMARKS

1. Don’t advertise the sale of marijuana anywhere near your trademark. In In re Morgan Brown, the applicant sought to register the trademark “Herbal Access” for “retail stores services featuring herbs.” The United States Patent and Trademark Office’s (“USPTO”) refusal to register the trademark was affirmed on appeal to the Board. The Board looked outside of the description of the services in the application. It found that the applicant’s advertising clearly showed that the “herbs” being sold were marijuana. The applicant’s website invited customers to "find out why people consider our marijuana to be the best of the best.” The Board stated that because “the applicant’s goods and services involve the sale of a good that is illegal under federal law, registration of the trademark was properly refused.”

1. Don’t advertise the sale of marijuana anywhere near your trademark. In In re Morgan Brown, the applicant sought to register the trademark “Herbal Access” for “retail stores services featuring herbs.” The United States Patent and Trademark Office’s (“USPTO”) refusal to register the trademark was affirmed on appeal to the Board. The Board looked outside of the description of the services in the application. It found that the applicant’s advertising clearly showed that the “herbs” being sold were marijuana. The applicant’s website invited customers to "find out why people consider our marijuana to be the best of the best.” The Board stated that because “the applicant’s goods and services involve the sale of a good that is illegal under federal law, registration of the trademark was properly refused.”

2. The Department of Justice’s Hands-Off Approach to Prosecutions Is No Help. In 2013, the Department of Justice (“DOJ”) issued a memo known as the “Cole Memo” which said that the DOJ would mostly avoid prosecuting a marijuana business in a state that has legalized it. In In re JuJu Joints, the applicant’s business was located in Washington State, which had legalized marijuana. The applicant tried to rely on the Cole Memo to justify the registration of its marijuana trademark. The Board rejected this argument. The Board’s opinion stated: "We cannot simply disregard the requirement of lawful use or intended lawful use in commerce under the Trademark Act, or Congress's determination as to what uses are illegal, regardless of the alleged business or consumer consequences of denying registration.”

2. The Department of Justice’s Hands-Off Approach to Prosecutions Is No Help. In 2013, the Department of Justice (“DOJ”) issued a memo known as the “Cole Memo” which said that the DOJ would mostly avoid prosecuting a marijuana business in a state that has legalized it. In In re JuJu Joints, the applicant’s business was located in Washington State, which had legalized marijuana. The applicant tried to rely on the Cole Memo to justify the registration of its marijuana trademark. The Board rejected this argument. The Board’s opinion stated: "We cannot simply disregard the requirement of lawful use or intended lawful use in commerce under the Trademark Act, or Congress's determination as to what uses are illegal, regardless of the alleged business or consumer consequences of denying registration.”

3. Congressional Funding Amendments are No Help. Congress has a recurring rider to budget legislation that bars the DOJ from using federal money to block states from implementing medical marijuana laws. In In re PharmaCann LLC, the Board rejected the applicant’s argument that the budget legislation was a basis to allow marijuana-related trademarks. The Board agreed that the recurring budget rider might signal that Congress is softening towards the idea of legalizing marijuana. However, until Congress enacts a law legalizing marijuana, an applicant can’t seek federal trademark protection.

3. Congressional Funding Amendments are No Help. Congress has a recurring rider to budget legislation that bars the DOJ from using federal money to block states from implementing medical marijuana laws. In In re PharmaCann LLC, the Board rejected the applicant’s argument that the budget legislation was a basis to allow marijuana-related trademarks. The Board agreed that the recurring budget rider might signal that Congress is softening towards the idea of legalizing marijuana. However, until Congress enacts a law legalizing marijuana, an applicant can’t seek federal trademark protection.

4. What an Applicant Says in a Trademark Application Can Hurt It. In a declaratory judgment case, Woodstock Ventures LC v. Woodstock Roots LLC, the plaintiff owned the Woodstock name for the music festival and began selling cannabis products using the same name. The defendant threatened to sue for trademark infringement. The defendant had sworn in its trademark application that its “smoker’s articles” would not be used to smoke marijuana. Since the plaintiff’s products were specifically designed for marijuana use, the defendant could not argue that a likelihood of confusion exists.

4. What an Applicant Says in a Trademark Application Can Hurt It. In a declaratory judgment case, Woodstock Ventures LC v. Woodstock Roots LLC, the plaintiff owned the Woodstock name for the music festival and began selling cannabis products using the same name. The defendant threatened to sue for trademark infringement. The defendant had sworn in its trademark application that its “smoker’s articles” would not be used to smoke marijuana. Since the plaintiff’s products were specifically designed for marijuana use, the defendant could not argue that a likelihood of confusion exists.

5. There Isn’t a Likelihood of Confusion between the Same Trademark Used for Cannabis Products and Non-Cannabis Products. Kiva Health Brands, Inc. sells health food under the name “Kiva”. It sued Kiva Brands LLC who manufactures and sells cannabis edibles legally in California. Each party moved for a preliminary injunction against the other party. The motions were denied. The court held that there was little likelihood of confusion because the products were sufficiently different from each other.

5. There Isn’t a Likelihood of Confusion between the Same Trademark Used for Cannabis Products and Non-Cannabis Products. Kiva Health Brands, Inc. sells health food under the name “Kiva”. It sued Kiva Brands LLC who manufactures and sells cannabis edibles legally in California. Each party moved for a preliminary injunction against the other party. The motions were denied. The court held that there was little likelihood of confusion because the products were sufficiently different from each other.

Conclusion: Until Congress passes legislation legalizing the use of marijuana, trademark protection will continue to be elusive.

If you have questions or need additional information, please contact an intellectual property attorney at Golan Christie Taglia, LLP.

NEW FINANCIAL HELP FOR STRUGGLING SMALL BUSINESS

The Small Business

Reorganization Act of 2019

is designed to be a debtor-

friendly reorganization option

for small businesses.

Since its enactment in the late 1970s, Chapter 11 of the Bankruptcy Code has given financially troubled businesses a chance to reorganize. The bankruptcy reorganization process can help a struggling business survive and ultimately thrive. A bankruptcy stays debt collection activity. It gives the debtor a chance to propose a plan to its creditors for repayment of outstanding debts. It saves jobs. It preserves and creates market streams. However, troubled small businesses often found themselves in a “donut hole”. The Chapter 11 reorganization process was too expensive and time consuming for them.

In 2005, Congress tried to help these “donut hole” debtors when it enacted an amendment to the Bankruptcy Code called the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (“BAPCPA”). Unfortunately, the small business portions of the BAPCPA amendment ended up hurting more than helping. The time frames and enforcement mechanisms made it harder for small businesses to reorganize in bankruptcy. Additionally, BAPCPA did not alleviate the high cost of a Chapter 11 reorganization. The attorneys’ fees and costs continued to make the process cost-prohibitive for a substantial number of small businesses.

Realizing the failure of BAPCPA for small businesses, Congress enacted the Small Business Reorganization Act of 2019 (“SBRA”) which went into effect on February 1, 2020. SBRA created Subchapter V to eliminate the small business debtor “donut hole”. SBRA is basically Chapter 11 but designed for small business debtors. To qualify, a Subchapter V small business debtor can have no more than $2,725,625 in secured and unsecured debts combined.

The streamlined process will help small businesses emerge from a reorganization faster. With this updated process, the attorneys’ fees and costs involved in the reorganization process will be greatly reduced.

Here are some Subchapter V highlights:

- A trustee will be appointed in every Subchapter V case. The trustee will act as a fiduciary for creditors, usually in lieu of the appointment of a creditors’ committee.

- A Subchapter V trustee will not operate the business of the small business debtor.

- Only the debtor may file a plan of reorganization, and it must do so within 90 days after the order for relief (which may be extended by the court “if the need for the extension is attributable to circumstances for which the debtor should not justly be held accountable”).

- The rules for the contents of a Subchapter V plan of reorganization are more debtor-friendly than under existing Chapter 11.

- A loan secured by the principal residence of the debtor may be modified by a Subchapter V plan if the proceeds of the loan were used for the small business.

- The requirements to confirm a plan are more debtor-friendly than under existing Chapter 11, particularly the rules for confirming a plan over the opposition of an impaired class of creditors.

If you know a business that is struggling financially and want to explore whether a Subchapter V would be appropriate, the turnaround and bankruptcy attorneys at Golan Christie Taglia can help.

ILLINOIS ENACTS EMPLOYER-FRIENDLY CANNABIS LAW AMENDMENT

Though the newly-enacted law expressly permitted employers to maintain and enforce “reasonable” drug-free workplace policies, the Cannabis Act’s employer protections appeared to conflict with Illinois’ Right to Privacy in the Workplace Act, which bars employers from discriminating against an employee who consumes “lawful products” off the premises while off-duty. Thus, as initially written, the Cannabis Act seemed to outright prohibit employers from disciplining or refusing to hire an individual based on a positive marijuana drug test alone.

On December 4, 2019, Governor Pritzker signed into law SB 1557 (Public Act 101-593), which amends the Cannabis Act to, among other things, clarify employers’ right to take adverse action pursuant to a “reasonable” workplace drug policy against employees and prospective employees who test positive for marijuana. Specifically, the amendments provide that an employer cannot be sued for “subjecting an employee or applicant to reasonable drug and alcohol testing, reasonable and nondiscriminatory random drug testing, and discipline, termination of employment, or withdrawal of a job offer due to a failure of a drug test.” In other words, an employer may take adverse action for a positive marijuana test so long as the employer’s drug testing policy is reasonable and applied in a nondiscriminatory manner.

The Cannabis Act amendments do not change Illinois’ Compassionate Use of Medical Cannabis Program Act, which generally prohibits an employer from penalizing a person based solely on his or her medical marijuana status. Thus, employers with strict drug-free workplace policies may still wish to consider making reasonable accommodations for off-duty medical marijuana use for the treatment of a disability.

If you have questions or need additional information, please contact an employment law attorney at Golan Christie Taglia, LLP.

ILLINOIS APPELLATE COURT SAYS CORPORATE SUCCESSOR IS LIABLE IN EMPLOYMENT DISCRIMINATION CASES

In People ex rel. Dep’t of Human Rights v. Oakridge Nursing & Rehab Ctr., 2019 IL App (1st) 170806, Illinois’ First District appellate court, as a matter of first impression, recognized a corporate successor’s liability for an employment discrimination claim brought against its corporate predecessor. Plaintiff Jane Holloway filed a Charge of Discrimination against her employer Oakridge Nursing & Rehab Center, LLC, alleging age and disability discrimination in violation of the IHRA. The company thereafter sold substantially all of its assets to Oakridge Healthcare Center, LLC. After Holloway obtained an administrative judgment against the old company, who failed to satisfy the judgment, the State filed a complaint against the new company, as the successor of Oakridge Center, to enforce compliance with Holloway’s judgment.

Generally, courts have found that the liability of successor employers is not automatic and must be determined on a case-by-case basis. On appeal, the State urged the First District appellate court to look to federal case decisions where successor liability is recognized as the default rule in employment discrimination cases. The appellate court agreed, finding that Illinois courts may also impose successor corporate liability where the underlying claim stems from a charge of employment discrimination under the IHRA.

The Oakridge Nursing decision is consequential because under certain circumstances, a successor company may find itself financially liable for its predecessor’s alleged bad acts that violate Illinois employment law. Thus, businesses and individuals seeking to acquire an existing business are encouraged to consult with experienced counsel to ensure due diligence in every aspect of a corporate transaction, including those related to labor and employment matters.

If you have questions or need additional information, please contact an employment law attorney at Golan Christie Taglia, LLP.

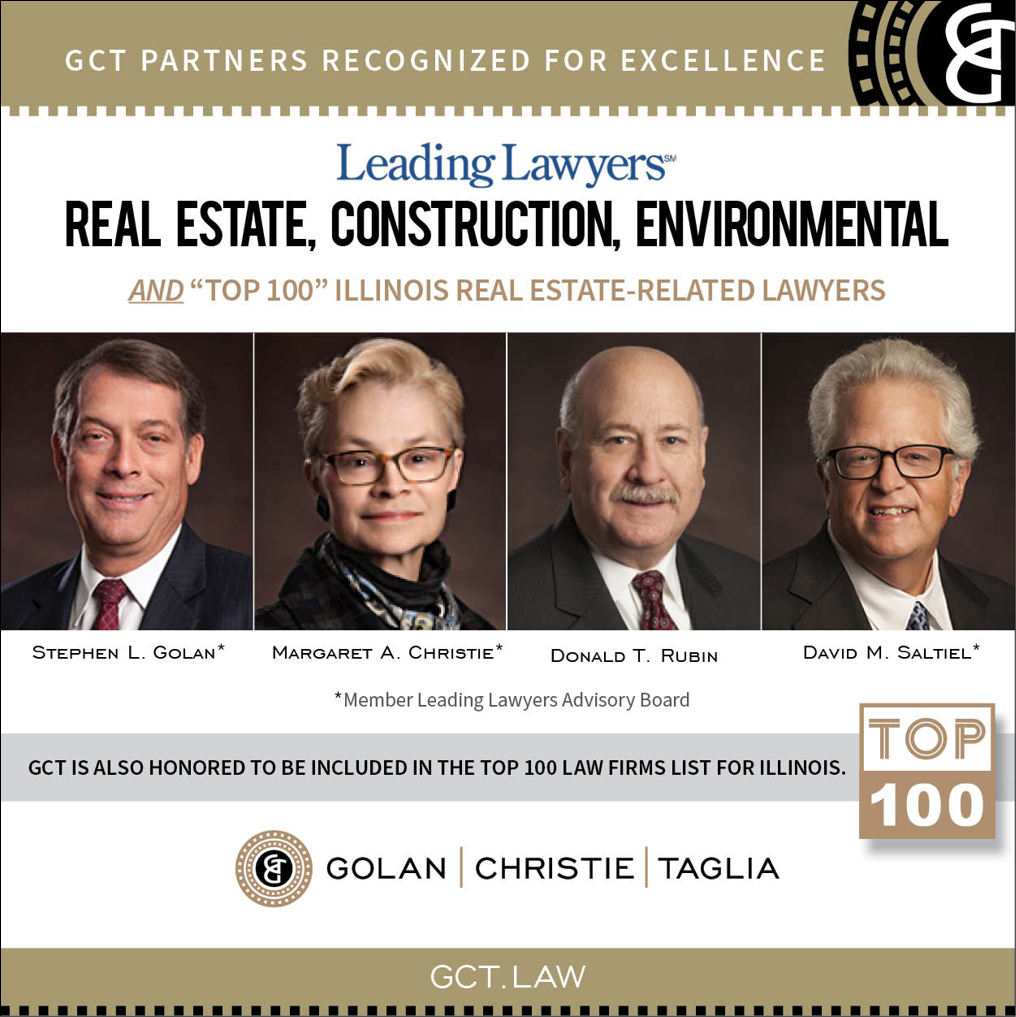

GCT ATTORNEYS RECOGNIZED

LEADING LAWYERS recently recognized four of our Golan Christie Taglia attorneys in the areas of real estate, construction and environmental. Congratulations to Stephen, Margaret, Donald and David for their ongoing commitment to excellence!

LEADING LAWYERS recently recognized four of our Golan Christie Taglia attorneys in the areas of real estate, construction and environmental. Congratulations to Stephen, Margaret, Donald and David for their ongoing commitment to excellence!

In addition, Golan Christie Taglia is also honored to be included in the TOP 100 LAW FIRMS list for Illinois.

CHICAGO LAWYER MAGAZINE recently recognized five of our own as Top Tax-Related Lawyers and Top Trust, Will & Estate Lawyers. Congratulations to Nancy, Donna, Barry, Anthony and Andrew!

CHICAGO LAWYER MAGAZINE recently recognized five of our own as Top Tax-Related Lawyers and Top Trust, Will & Estate Lawyers. Congratulations to Nancy, Donna, Barry, Anthony and Andrew!

UPCOMING EVENT

On April 16, 2020 Golan Christie Taglia partner, David M. Saltiel, will be presented with the Distinguished Alumni Award at the University of Illinois College of Law Annual Alumni Dinner. For more information about the 2020 Annual Alumni Dinner, please contact Heather Ball at law-alumni@illinois.edu.

OUR FOCUS ON YOUR SUCCESS IS MORE THAN JUST OUR TAGLINE. IT IS OUR MISSION AND OUR COMMITMENT TO OUR CLIENTS. WE WOULD LIKE TO SHARE A CLIENT’S SUCCESS STORY THAT DEMONSTRATES THAT COMMITMENT.

LITIGATION GROUP VICTORIOUS IN DOMESTIC VIOLENCE COURT

CHALLENGE: A client became aware that a seemingly malicious Order of Protection had been entered against her months earlier. She had not been notified that a Petition for Order of Protection had been filed and therefore was not present at the original hearing to defend herself. GCT’s initial attempts at negotiations with the Petitioner’s attorney were unsuccessful.

STRATEGY: Our attempt to negotiate a dismissal was rebuffed by the Petitioner’s attorney. During discovery, we learned that the Petitioner, who held an executive position on our client’s Condo Association Board, was unhappy that our client had questioned some of his actions as President. The Petitioner had instructed the Condo Association’s lawyer to file the initial order. Based on obvious conflict of interest, GCT had the lawyer removed, but the Petitioner persisted, and GCT was compelled to go to hearing.

RESULTS: The hearing relied solely on the Petitioner’s testimony. On cross examination, GCT’s line of questioning revealed inconsistencies in the Petitioner’s story, and an admission that a sworn affidavit that he had submitted to the Court contained numerous falsehoods—destroying his own credibility. A motion for a directed finding was granted by the Judge and the Petition was dismissed, without our client even having to testify.