FROM OUR MANAGING PARTNER

Fall 2012 Newsletter

FROM OUR MANAGING PARTNER

Fall 2012 Newsletter

Welcome to the Fall 2012 edition of the Golan & Christie Newsletter. This issue deals with important and timely topics that affect you and your business, including:

GIFT TAX UPDATE

Is it better to give than to receive? From a purely tax perspective, the answer is generally no, since the person giving the gift may be subject to a federal gift tax, while the recipient generally is not. This article discusses gift giving and estate tax reduction ideas that are scheduled to expire at the end of this year.

BUY SELL AGREEMENTS FOR BUSINESS OWNERS

The best time to plan for long term ownership and management issues is when the company is new and everyone is getting along. Whether the business is a corporation, limited liability company or a partnership, one of the most important things owners in a new company can do is enter into a buy-sell agreement.

HARASSMENT IN THE WORKPLACE

This article highlights a lesson for employers of any size when harassment or discrimination allegations are made by an employee, they must investigate promptly and thoroughly, and if the conduct continues, further action must be taken.

Golan & Christie has just entered our 19th year of providing high quality legal services to our clients. We would like to thank you for your past support and we look forward to continuing to be a trusted advisors in the future to help ensure your success.

-Stephen L. Golan

Managing Partner

GIFT TAX UPDATE

Is it Better to Give than to Receive?

"The exemption from the federal gift tax has never been higher. In 2012, an individual can give away as much as $5,120,000 ($10,240,000 per married couple) without paying federal gift taxes.”

GIFT TAX UPDATE

Is it Better to Give than to Receive?

Is it better to give than to receive? Purely from a tax perspective, the answer is generally no, since the person giving the gift may be subject to a federal gift tax, while the recipient generally is not.

Hotly debated both before and since its passage in 2010, there likely will be more legal challenges, rules, and regulations before most of ObamaCare’s requirements for employers take effect in 2014. But as the law stands now, the significant obligations for employers under ObamaCare are summarized below.

Federal Gift Tax Exemption has Never Been Higher

The exemption from the federal gift tax has never been higher. In 2012, an individual can give away as much as $5,120,000 ($10,240,000 per married couple) without paying federal gift taxes. It should be noted that the exemption is reduced by prior lifetime taxable gifts. The increased generation-skipping transfer (“GST”) tax exemption permits these gifts to benefit grandchildren and more remote descendants. This tax exemption for lifetime gifts is in addition to the annual gift tax exclusion that covers gifts of up to $13,000 ($26,000 per married couple) per recipient per year, as well as the exclusion for certain

Unique Gifting Opportunity in 2012

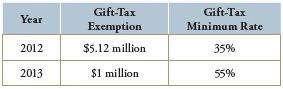

The gift tax exemption is slated to decrease to its traditional level of $1 million at midnight on December 31, 2012. In addition, the gift tax rates will increase from 35% to a maximum of 55%, as illustrated below:

The impact of this change is that an individual can make a large gift in 2012 without incurring any gift tax, while the same gift made in 2013 (or any subsequent year) will result in a significant gift tax liability.

Benefits of Making Gifts in 2012

Making a sizable gift in 2012 has several benefits. First, a gift in 2012 represents what could be a onetime opportunity to transfer wealth to children or other beneficiaries without paying a gift tax and to accomplish multi-generational planning without paying any GST tax. Second, these gifts can save estate taxes by removing the future appreciation on and income from the gifted asset from an individual’s estate. Finally, the value of some gifted assets, specifically minority interests in closely held businesses, can be discounted for gift tax purposes.

Prior to making these gifts, you should consider a number of factors, including lifestyle choices, realistic future cash flow needs, what assets should be given, the impact the gift will have on the recipients, and incorporation of the gift into your overall estate plan.

Three Months Left

Proper planning takes time, since your professional team needs to create a well thought out gifting strategy, draft the necessary documents, and implement the plan. Moreover, if you are considering making a gift of a business interest or an interest in real estate, additional time is needed to obtain a qualified appraisal of the interest. If you or your family members are contemplating gifting to take advantage of this unique window of opportunity, please contact us. Even if you don’t feel that you are in a position to make a large gift at this time, we would be happy to speak with you about the advantages of making gifts as part of your comprehensive estate planning.

Contact Donna F. Hartl, Barry P. Siegal or Nancy Franks-Straus to discuss gifting and other estate planning strategies that could benefit you.

BUSINESS OWNERS

Do You Have Your Buy-Sell Agreement In Place?

“Whether the business is a corporation, limited liability company or partnership, one of the most important things owners in a new company can do is enter into a buy-sell agreement.”

BUSINESS OWNERS

Do You Have Your Buy-Sell Agreement In Place?

When starting a new business, owners, rightfully so, are focused on getting operations up and running and making the business profitable. If there is more than one owner, everyone is usually in a “honeymoon” period where everyone is getting along and everyone believes that the business will last forever.

Because of this, the best time to plan for long-term ownership and management issues is when the company is fairly new and everyone is getting along. Whether the business is a corporation, limited liability company or partnership, one of the most important things owners in a new company can do is enter into a buy-sell agreement. With a properly drafted buy-sell agreement, business owners can:

- Avoid complex negotiations and or litigation when an unforeseen event occurs (such as the death of an owner);

- Preserve control for the existing owners;

- Facilitate succession planning for the owners; and

- Avoid disruptions in management.

Typically, when business partners start a new business, they intend to go into business and stay in business with their business partners, not their business partners’ spouses, children, friends or worse, creditors. A buy-sell agreement can restrict an owner’s ability to transfer his/her equity interest in the company. Additionally, the buy-sell agreement can also provide for what happens to an owner’s equity interest in the company upon the occurrence of certain “triggering events”, which typically include the:

- Death

- Disability

- Insolvency

- Retirement of an owner, or Divorce of an owner or when an owner ceases to be actively involved in the company.

Upon such a “triggering event,” the buy-sell agreement can allow (or require) the Company to repurchase the equity interest of said owner - a concept known as “redemption”. Alternatively, the buy-sell agreement can grant such an option (or obligation) directly to the other owners of the company – a concept known as “cross-purchase.”

The agreement should clearly state how to determine the value of the company and the equity interest to be purchased and should provide one of the following methodologies for determining the purchase price:

- A price mutually agreed upon by the owners, provided that the price is revisited (typically annually) to make sure it remains fair and consistent with the ever-changing value of the company;

- Setting a formula, such as a multiple of Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), at the time of the “triggering event”; or

- The appraised value of the company as determined by independent appraisers at the time of purchase of the selling owner’s equity interest.

To ease the burden, a company may purchase disability insurance on its owners for the purpose of funding the purchase of the owner’s equity interest in the company in the event of his/her death or disability.

Having an effective buy-sell agreement in place can allow for a smoother transition during an otherwise difficult time. It also ensures that ownership will remain with the individuals who were always intended to be the owners. There can be a lot of risk and uncertainty in starting and operating a business. It is unnecessary to increase this risk and uncertainty by not having a clearly articulated buy-sell agreement right from the start.

If you have any questions regarding buy-sell agreements, please contact Darrin S. Baim or Richard M. Wallace.

New Law Says Employers Cannot Ask For Social Media Passwords

New Law Says Employers Cannot Ask For Social Media Passwords

Illinois has a new law which goes into effect on January 1, 2013, that makes it illegal for employers to ask job applicants or employees for passwords to their Facebook accounts or other online profiles.

The new law, which amends the Illinois Right to Privacy in the Workplace Act, makes Illinois only the second state to enact this kind of law, though Maryland, New York, California, and Washington have introduced similar legislation. Under the Illinois law, there are no exceptions, not even for jobs requiring background checks. Employers are still permitted to maintain lawful workplace policies relating to use of the Internet, social networking sites and electronic mail. The law also permits employers to access information regarding current and prospective employees that is in the public domain and obtained without a password.

According to bill sponsor Rep. La Shawn Ford (D-Chicago), “Social networking accounts are places where we document the personal and private aspects of our lives,” Ford said, “and employers have realized they can get answers to questions they are prohibited from asking by gaining unfettered access to our accounts. This legislation may protect employers from future lawsuits as much as it protects employees and job-seekers.”

Employer Must Pay $3.5 Million In Punitive Damages For Failing To Take Sufficient Action To Investigate And Stop Harassment

Employer Must Pay $3.5 Million In Punitive Damages For Failing To Take Sufficient Action To Investigate And Stop Harassment

In a recent opinion from the 7th Circuit Court of Appeals, which covers Illinois, Indiana and Wisconsin federal courts, a $3.5 million jury award was affirmed for an employee who alleged his employer did not do enough to stop anonymous harassment and threats he received at work.

The case, Otto v. Chrysler Group, LLC, (August 23, 2012), involved claims under federal anti-discrimination laws. According to the appellate court’s decision, Chrysler’s head of human resources at the plant where the plaintiff worked learned of the anonymous harassment, including death threats, directed at the plaintiff and met with two groups of employees to remind them that harassment was unacceptable. Additionally, a procedure was implemented to document the harassment, efforts were made to discover who was at the plant during the periods when the incidents likely occurred, and a handwriting analyst was retained and used. Unfortunately, the harasser or harassers were never caught. At trial, a jury found that these efforts by Chrysler were insufficient given the severity of the harassment. In determining the damages due to the plaintiff, the jury found that the company did not act “promptly and adequately” to stop the harassment and that, in fact, the company acted “with reckless indifference” to the employee’s rights. The appellate court agreed with the jury and explained that Chrysler should have installed surveillance cameras and interviewed the employees listed by the plaintiff as potential witnesses.

The lesson for employers of any size is that when harassment or discrimination allegations are made by an employee, they must be investigated promptly and thoroughly and if the conduct continues, further action must be taken.

Contact employment attorneys Margaret A. Gisch or Laura A. Balson to discuss how these issues apply to your company.

Golan & Christie Partner To Present Public Speaking Seminar

Golan & Christie Partner To Present Public Speaking Seminar

For the second year in a row, Peter M. Katsaros will be teaching at the upcoming Pincus Professional Education workshop:

Public Speaking & Acting Skills:

Present More Effectively In or Out of Court

October 19, 2012, 9am - 4:45pm

The Conference Center at UBS Tower, One North Wacker Drive, 2nd Floor, Chicago

The program has been approved for 6.0 hours of CLE credit in Illinois, including credit for professional responsibility.

You can register by calling (530) 877-8700.

Golan & Christie Partner Receives 2012 Person Of Impact Award

Golan & Christie Partner Receives 2012 Person Of Impact Award

On September 5, 2012, Barbara L. Yong was honored by the League of Women Voters of the LaGrange Area with the 2012 Person of Impact Award. According to the League, “The award was created to honor individuals, non-profit organizations or government entities that are considered ‘change-makers’ and have made significant contributions in encouraging citizens to engage in the democratic process.” Golan & Christie congratulates Ms. Yong on her achievement.

WELCOME

WELCOME

Golan & Christie is pleased to welcome a new attorney to the firm:

Brianna Golan is a 2009 graduate of the John Marshall Law School. She has been an associate at Maciorowski, Sackmann & Ulrich for the past 3 years specializing in workers’ compensation defense litigation. While in law school, Ms. Golan externed for Judge Jesse Reyes and Judge Bill Taylor. She did her undergraduate work at Lewis & Clark College in Portland, Oregon where she majored in English and minored in Communications. Ms. Golan’s practice at Golan & Christie will focus on commercial litigation.