FROM OUR MANAGING PARTNER

Spring 2015 Newsletter

FROM OUR MANAGING PARTNER

Spring 2015 Newsletter

Spring is in the air, and between growing your gardens, as well as your business, we hope you enjoy reading this edition of the Golan & Christie Newsletter. We’ve selected key issues and news items that we feel are interesting and could have an impact on your business.

CHAPTER 11 AS A REMEDY FOR BUSINESSES IN FINANCIAL CRISIS

Insolvent businesses, regardless if due to a balance sheet test or unpayable debts, need to act responsibly to prevent creditors from imposing personal liability for business debts.

NLRB’S EMPLOYEE HANDBOOK GUIDELINES

The National Labor Relations Board issued a detailed memo concerning certain common employment policies that the NLRB considers overly broad and potentially illegal.

IP LAW ALERTS

Your website is your organization’s face to the world. Too often, the website is taken for granted and some things can fall through the cracks. We recommend a “website checkup” at least once a year.

In this newsletter you’ll also find information on bankruptcy protection and Andrew Williams’ unusual voluntary compliance program proposal to the IRS.

We hope you find this newsletter informative and helpful. It’s just another way Golan & Christie strives to keep our clients “one step ahead.” Have an enjoyable and prosperous spring.

-Stephen L. Golan

Managing Partner

BANKRUPTCY UPDATE

Chapter 11 as a Remedy for Businesses in Financial Crisis

"Businesses can use Chapter 11 to reorganize or liquidate. Chapter 11 is a reorganization proceeding, also under the supervision of the Bankruptcy Court, but typically with the debtor continuing to run the business."

"It is possible for struggling and cash-strapped businesses to change their business model, obtain new financing, restructure existing debt and negotiate payment plans with their creditors without filing a bankruptcy."

BANKRUPTCY UPDATE

Chapter 11 as a Remedy for Businesses in Financial Crisis

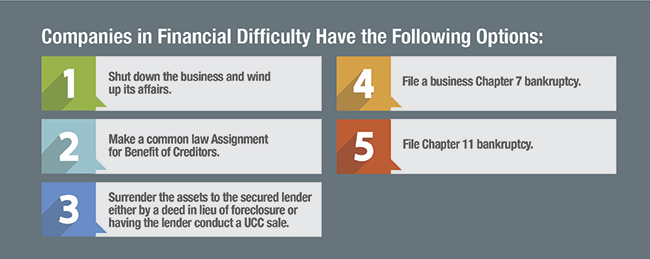

Owners of businesses that are insolvent, regardless of whether the insolvency is determined using the balance sheet test (meaning their liabilities exceed their assets) or because they are unable to pay their debts as they come due, need to act responsibly to prevent creditors from imposing personal liability for business debts. Once a business is insolvent, the owners have a fiduciary duty to act in the best interest of their creditors to either turn the business around and make it profitable or to shut it down to prevent a deepening insolvency on the backs of the creditors.

Businesses can use Chapter 11 to reorganize or liquidate. Chapter 11 is a reorganization proceeding, also under the supervision of the Bankruptcy Court, but typically with the debtor continuing to run the business. Chapter 11 debtors are usually larger companies (though we now know none are “too big to fail,”) or wealthy individuals, in part because of the complexity and expense of the Chapter 11 process itself.

BENEFITS OF CHAPTER 11

- Immediately upon filing, the debtor is entitled to the protections of the automatic stay. This prevents creditors from taking any action to collect their debts. It puts alllitigation on hold and can prevent a lender from proceeding with a foreclosure of its mortgage or a UCC sale of business assets. This provides a small business a little bit of breathing room.

- The debtor can also reject unfavorable contracts like leases or rental agreements. This allows a small business to close locations and get relief from above-market rent.

- The debtor can also borrow new money through a debtor-in-possession or DIP loan, and give the lender a super-priority lien, which puts them ahead of the business’ existing lenders.

- Debtors can also sell some or all of their assets (including real estate, machinery and equipment, vehicles, and even intellectual property) free and clear of liens and claims, with the liens attaching to the proceeds of the sale.

- Debtors can also renegotiate terms of their collective bargaining agreements, provided the negotiations are conducted in good faith.

- The debtor also gets a reprieve from paying its pre-bankruptcy debts while it is in Chapter 11. During this time, the debtor can accumulate a surplus to help strengthen the business after bankruptcy.

- Finally, debtors can pay their pre-bankruptcy debt over time through a plan. Certain claims like taxes, which are given priority, will need to be paid in full. For most claims, however, a fraction of the amount owed can be paid on a pro rata basis over several years. Business debtors do not, however, receive a discharge.

Can some or all of this be done outside of a bankruptcy? No - these protections only exist in bankruptcy.

Is Chapter 11 the answer for every small business that either can’t afford to pay its creditors or finds itself upside down? No, but it should be considered, along with the other less costly options. These options should be discussed with experienced bankruptcy counsel. It is especially important if the business is continuing to lose money and can only survive by increasing the debts to its trade creditors or failing to pay payroll taxes, both of which can subject the business owner to personal liability.

It is possible for struggling and cash-strapped businesses to change their business model, obtain new financing, restructure existing debt and negotiate payment plans with their creditors without filing a bankruptcy. But when all else fails, Chapter 11 should at least be considered as an option before shutting the doors.

While Chapter 11 is expensive, the costs can be quite reasonable compared to the valuable benefits Chapter 11 can provide, not to mention the huge amount of debt which can be eliminated from a small business’ bottom line.

Contact Barbara Yong, (312)696.2034, or blyong@golanchristie.com if and when your business is in financial difficulty to review the options. There is no charge for her initial consultations.

NLRB’s General Counsel Issues Guidelines For Employee Handbooks

NLRB’s General Counsel Issues Guidelines For Employee Handbooks

On March 18, 2015, the Office of the General Counsel for the National Labor Relations Board (the NLRB is the federal agency tasked with enforcing the National Labor Relations Act (NLRA), which, generally speaking, protects employees’ right to discuss the terms and conditions of their work and to organize unions), issued a detailed memo concerning certain common employment policies that it considers overly broad and potentially illegal. The following are examples of the types of policies addressed in the memo:

-

Confidentiality Rules. The NLRB emphasized that employees have a right to discuss “wages, hours and other terms and conditions of employment.” As a result, “broad prohibitions on disclosing ‘confidential’ information” to protect “the privacy of certain business information” are only acceptable if certain conditions are met.

Here is language the NLRB considers overly broad:

Do not discuss customer or employee information outside of work, including phone numbers and addresses.

On the other hand, here’s an example of confidentiality language that is deemed acceptable by the NLRB:

No unauthorized disclosure of business ‘secret’ or other confidential information.

-

Restrictions on Leaving Company Property. Because the NLRA puts the ability to strike as one of workers’ fundamental rights, policies that limit employees’ ability to leave work are highly scrutinized:

Walking off the job is prohibited.

This language, however, is suitable in the NLRB’s eyes:

Entering or leaving Company property without permission may result in discharge.

-

Employees’ Criticism of Management. The NLRB notes that employees have the “right to criticize or protest their employer’s labor policies or treatment of employees.” As a result, the NLRB considers this policy problematic:

Be respectful to the company, other employees, customers, partners, and competitors.

But this statement is lawful:

Each employee is expected to work in a cooperative manner with management, coworkers, customers and vendors.

-

Employees’ Interactions with Coworkers. In addition to the employee/manager relationship, the NLRB addressed language about employees’ interactions with one another.

Here is an example of what the NLRB finds inappropriate:

Do not make insulting, embarrassing, hurtful or abusive comments about other company employees online, and avoid the use of offensive, derogatory, or prejudicial comments.

An example of what it thinks is appropriate:

Threatening, intimidating, coercing, or otherwise interfering with the job performance of fellow employees or visitors.

As the above examples make clear, there is a thin line between a policy that complies with the NLRA and one that potentially does not. Company handbooks should be reviewed annually, at least, and any changes should be discussed with an employment attorney.

To discuss how these issues apply to your company contact: Laura A. Balson, (312)696-1351, labalson@golanchristie.com or Margaret A. Gisch, (312)696-2039, magisch@golanchristie.com.

Your Website Needs A Checkup

Your Website Needs A Checkup

Your website is your organization’s face to the world. Too often, the website is taken for granted and some things can fall through the cracks. We recommend a “website checkup” at least once a year.

Here’s a list of sample checkup questions:

- Domain Name: Who owns the domain name? Did a third party vendor or an employee register your domain name? What will happen when that relationship ends? Will the third party vendor or employee hold the domain name “hostage” as leverage?

- Website Design and Hosting: Who owns the website? Do you have the right to control the content, the graphics, and the look and feel of the website?

- Website Security: Hacking is so widespread that anyone can be a target at any time. Confidential information and users’ personal information must be protected.

- Do you have the right to use the content on your website? Do you own or have licenses for all text, graphics and photos that appear on your website?

- Does your website allow others to post content? If so, what are you doing to protect yourself from liability if someone posts infringing content on your website?

- Are your Terms of Service and Privacy Policy up to date: As issues arise, the Terms of Service and Privacy Policy can protect your business. Outdated terms and policies can be more harmful than none at all.

These questions allow you to engage in preventative maintenance, which is a cost-effective method to protect your business and its intellectual property.

GOOGLE ANNOUNCES A MARKETPLACE TO BUY AND SELL PATENTS

In 2014, over 615,200 patent applications were filed and over 326,000 patents were issued by the United States Patent and Trademark Office. These statistics increase substantially every year. Not every patent is “practiced,” meaning not every patent is actually used by the patent holder. Some of these patent holders hope to sell or license their invention in exchange for a lucrative payday. The problem lies in finding potential buyers and licensees.

On May 8, 2015, Google did a soft launch of a program that allows patent holders to post their patents for sale or license and set their own prices: http://www.google.com/patents/licensing. Google plans to allow the use of the website on a limited basis. If all goes well, Google will launch the fully functional website in August 2015, so stay tuned!

To discuss how these issues apply to your company contact:

Beverly A. Berneman (312)696-1221, baberneman@golanchristie.com

G&C Announcements

Golan & Christie Partner Convinces Irs To Approve Unusual Voluntary Compliance Program Proposal

G&C Announcements

Golan & Christie Partner Convinces Irs To Approve Unusual Voluntary Compliance Program Proposal

A client consulted Golan & Christie Partner, Andrew Williams, concerning a problem with its 401(k) plan. The plan, which had been amended by the financial institution providing services to the plan, mistakenly added a fixed rate of employer matching contributions, although the plan had previously contained a discretionary formula. The discretionary formula allowed the employer to determine the match (including the discretion to make no matching contribution) on a year-by-year basis. Unaware of the change, after the amendment, the employer elected to make no matching contributions as a result of declining revenues during a period of sluggish economic growth. A routine private audit of the plan disclosed the employer’s liability to fund the matching contribution at the higher fixed rate, in an amount of more than $200,000.

The client decided to pursue an administrative filing with the IRS under its Voluntary Compliance Program (“VCP”) to resolve the situation by retroactively amending the plan to eliminate the fixed formula for matching contributions and to replace it with a discretionary formula. The proposal conformed the plan document to the client’s actual contribution pattern. However, the IRS does not normally allow a retroactive plan document to “cut back” plan benefits. The client elected to have Golan & Christie prepare and submit a VCP proposal to the IRS that required only a retroactive plan amendment and no additional corrective payment. The unique proposal was accepted by the IRS, which granted a favorable “compliance statement” to resolve the matter for IRS audit purposes. As a result, the client saved over $200,000 in retroactive matching contributions to the plan and still obtained a favorable resolution of its compliance problem. Although this particular saga has a happy ending, the client may have avoided the problem entirely by having legal counsel review its plan document at the outset.

GOLAN & CHRISTIE OPENS NEW LOCATION IN NORTHBROOK

In a continuing effort to make our attorneys even more accessible to clients, the Firm is proud to announce the opening of our north suburban office at 5 Revere Drive in Northbrook. The new location, which is available for meetings by appointment only, is conveniently located just south of Lake Cook Road and quickly accessible to I-94.

Congratulations to Golan & Christie’s Clients!

Congratulations to Golan & Christie’s Clients!

Golan and Christie is excited to support its clients recently nominated for the 2015 Moxie Awards. The Moxie Awards, presented by Built in Chicago, recognize Chicago’s most innovative digital entrepreneurs. Winners will be announced on June 11, 2015. Congratulations to the nominees!

|

|

|

|

|

|