-

September 8, 2019 EventsScotiabank Convention Centre, 6815 Stanley Ave, Niagara Falls, CanadaProperty Tax Assessment

Please join Golan Christie Taglia attorney James W. Chipman for his presentation at the 85th Annual International Conference on Assessment Administration to be held in Niagara Falls, Ontario on Tuesday, September 10, 2019 at 10:45 a.m.

Read More -

September 4, 2019 NewsProperty Tax Assessment

New Trier Township is located in Cook County, IL. The entire township was subject to a reassessment in 2019. The Assessor opened the township for appeals on April 29 2019. The Assessor then certified the final assessments for all real estate in the township on August 15, 2019, meaning that he had completed his work for the year and closed his books.

Read More -

September 4, 2019 Property Tax Insights

New Trier Township is located in Cook County, IL. The entire township was subject to a reassessment in 2019. The Assessor opened the township for appeals on April 29 2019. The Assessor then certified the final assessments for all real estate in the township on August 15, 2019, meaning that he had completed his work for the year and closed his books.

Read More -

August 22, 2019 NewsProperty Tax Assessment

The Assessor proposed a 2019 market value of approximately $1,744,000 for a property. The party purchased the property for approximately $1,150,000 at the end of 2018 in an arm's length, brokered transaction. The evidence tendered in support of the appeal included the following documents:

Read More -

August 22, 2019 Property Tax Insights

The Assessor proposed a 2019 market value of approximately $1,744,000 for a property. The party purchased the property for approximately $1,150,000 at the end of 2018 in an arm's length, brokered transaction. The evidence tendered in support of the appeal included the following documents:

Read More -

July 25, 2019 EventsWebinar 12:00pm - 1:00pm CST Followed by Q&A

Ways employers can maintain a compliant 401(k) plan and be proactively prepared to defend their practices.

Read More -

July 8, 2019 NewsProperty Tax Assessment

The Cook County Assessor continues his relentless vendetta against business properties in north suburban Cook County. Unprecedented assessment increases upward of 200-300% are being mailed to unsuspecting taxpayers.

Read More -

July 8, 2019 Property Tax Insights

The Cook County Assessor continues his relentless vendetta against business properties in north suburban Cook County. Unprecedented assessment increases upward of 200-300% are being mailed to unsuspecting taxpayers. Every property is being treated as institutional grade investment property, from mom and pop storefronts to small apartment buildings. The assumption that all properties are being leased on a triple net basis allows the Assessor to eliminate property taxes as an expense, which results in higher net incomes and allows the use of much lower capitalization rates. These low rates only allow for a return of the investment necessary to cover debt service, not a return on the investment which allows a return on owner equity. This practice is being used to greatly increase the market value of virtually every commercial and industrial property in the north and northwest suburbs. While claiming complete transparency, Freedom of Information Requests filed on behalf of taxpayers by their attorneys to determine the reason for a denial of relief, are taking upwards of 6 weeks to process, while the law requires a response in not more than 10-days. When responses do become available, a review indicates how the Assessor is manipulating data to ensure that virtually every appeal will be denied. The good news is that the Board of Review has opened a month early, in anticipation of a huge increase in the volume of appeals due to the Assessor's refusal to grant relief, even on the most meritorious cases. The Board has also disclosed that it will continue to review cases as it always has, and will grant relief on the merits of each case, without a pre-determined policy intended to find any means to deny relief to property taxpayers who could see their tax bills skyrocket due the Assessor's failure to act in a fair and equitable manner.

Read More -

July 2, 2019 News PRESS

Chicago, IL - Golan Christie Taglia, LLP filed a complaint today in the Circuit Court of Cook County, Illinois alleging breach of contract on behalf of Teepu Siddique, MD, faculty member of Northwestern University Feinberg School of Medicine.

Read More -

June 24, 2019 Newsletters

- New Federal Tax Laws Amend Deductibility Of Government Fines

- New EEO-1 Reporting Requirements And Salary History Ban

- What You Should Know About Amazon’s Brand Registry

- GCT Attorneys Recognized And Honored

-

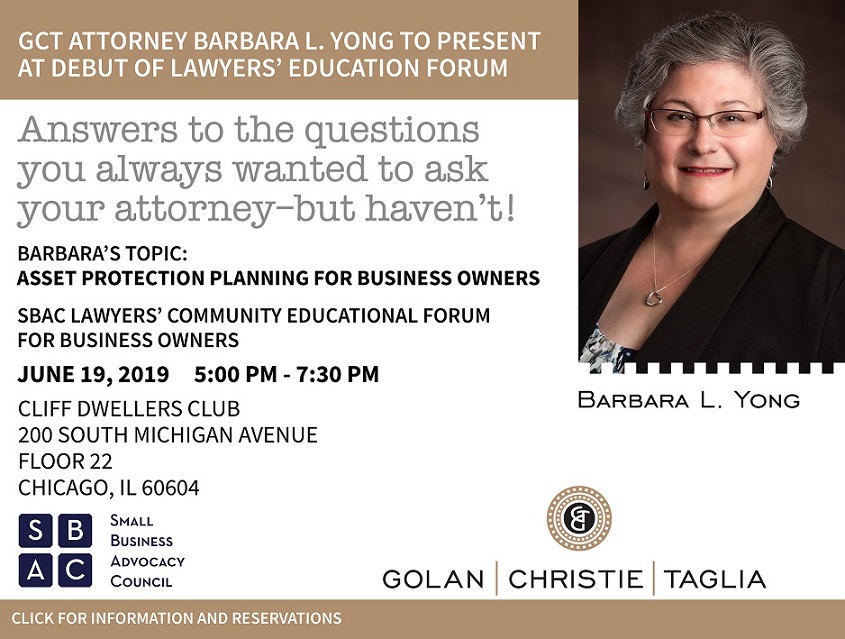

June 19, 2019 EventsCliff Dwellers Club, 200 South Michigan Avenue, Floor 22, Chicago, IL 60604Commercial & Business Litigation, Employment Law, Intellectual Property

Please join Golan Christie Taglia attorney, Barbara L Yong, at the SBAC Lawyers’ Community Educational Forum for Business Owners for her presentation regarding asset protection planning for business owners.

Read More -

May 3, 2019 NewsProperty Tax Assessment

Has the value of your business property actually increased by 82% in just 3-years?

Read More -

May 3, 2019 Property Tax Insights

Has the value of your business property actually increased by 82% in just 3-years?

Read More -

April 24, 2019 NewsProperty Tax Assessment

In the first three townships having a significant commercial and/or industrial tax base, (Norwood Park, Evanston and Elk Grove, the new assessor has been increasing market values by as much 50 to 300%. He claims that properties in the northern suburbs have been grossly underassessed for years, hence a 1-year catch-up was justified.

Read More -

April 24, 2019 Property Tax Insights

In the first three townships having a significant commercial and/or industrial tax base, (Norwood Park, Evanston and Elk Grove, the new assessor has been increasing market values by as much 50 to 300%. He claims that properties in the northern suburbs have been grossly underassessed for years, hence a 1-year catch-up was justified. Of course, no consideration was given to the jobs that will be lost as tenants and companies relocate, nor to the investors who will no longer invest in Cook County, nor to the companies that will no longer consider locating in Cook County, nor to the existing companies that will jettison their expansion plans. The same is true for owners of residential income properties that have also experienced significant increases. Who will be able to afford the higher rents that landlords will try to pass on to them? As to the homeowners, many of whom saw only minor increases, what will become of their property values if local jobs disappear and they cannot sell their houses? To date, the assessor has stubbornly refused to grant relief on a vast majority of commercial and industrial appeals, as his property valuations are apparently perfect.

Read More -

April 17, 2019 NewsTHE NEVER ENDING BATTLE BETWEEN QUALIFYING FACTORS FOR RECEIVING A CHARITABLE PROPERTY TAX EXEMPTIONProperty Tax Assessment

In the never ending battle between the qualifying factors for receiving a charitable property tax exemption as first enunciated in the Korzen case, Methodist Old Peoples Home v. Bernard Korzen, County Treasurer, et al, 233 N.E, 2d, 537, 39 Ill.2d 149 (1968), the Illinois Supreme Court initially set forth the following criteria for successfully obtaining a property tax exemption.

Read More -

April 17, 2019 Property Tax InsightsTHE NEVER ENDING BATTLE BETWEEN QUALIFYING FACTORS FOR RECEIVING A CHARITABLE PROPERTY TAX EXEMPTION

In the never ending battle between the qualifying factors for receiving a charitable property tax exemption as first enunciated in the Korzen case, Methodist Old Peoples Home v. Bernard Korzen, County Treasurer, et al, 233 N.E, 2d, 537, 39 Ill.2d 149 (1968), the Illinois Supreme Court initially set forth the following criteria for successfully obtaining a property tax exemption.

Read More -

April 13, 2019 Newsletters

- The Basics Of The Illinois’ Biometric Information Privacy Act (BIPA) And What Your Business Must Do To Comply

- New Salary Minimums Proposed By The Department Of Labor (DOL) And California Requires Harassment Training For Everyone

- The Trademark Trial And Appeal Board (TTAB) Pilot Program That Could Expedite The Trademark Cancellation Process

- Golan Christie Taglia Welcomes New Litigation Attorney, Announces Partner Promotions, And Introduces A Learning Series

-

March 13, 2019 News PRESSEntertainment Law

Chicago, IL - Golan Christie Taglia, LLP is excited to announce that Steven J. Rosenberg has joined the firm. As a successful civil and criminal litigator for over 40 years, trying over 100 cases to verdict in both state and federal courts, Steven J. Rosenberg brings extensive experience in mail and wire fraud and other white-collar crime, SEC investigations, accounting and securities fraud, complex civil litigation, medical negligence, and employment cases involving breach of contract and civil rights violations.

Read More -

March 8, 2019 NewsProperty Tax Assessment

A board of review decision can also be appealed directly to a circuit court. It’s an option that taxpayers often overlook!

Read More -

March 8, 2019 Property Tax Insights

Boards of review don’t have the final say about property tax assessments, however they’re a necessary stop in the appeal process. Taxpayers who are unhappy with their board decision have two options: appeal to the state Property Tax Appeal Board (PTAB) as described in my Aug. 24, Sept. 12 and Nov. 27 blogs; or, file a tax objection complaint in the circuit court. You cannot file appeals in both venues. The good news is that taxpayers who miss the 30-day filing deadline for taking an appeal to the PTAB still have time to pursue the tax objection remedy.

Read More -

March 6, 2019 NewsEmployment Law

We are pleased to announce that Steven J. Rosenberg has joined the firm. As a successful civil and criminal litigator for over 40 years, trying over 100 cases to verdict in both state and federal courts, Steve brings extensive experience in mail and wire fraud and other white collar crime, SEC investigations, accounting and securities fraud, complex civil litigation, medical negligence, and employment cases involving breach of contract and civil rights violations.

Read More -

February 11, 2019 NewsProperty Tax Assessment

There’s a remedy for correcting errors or mistakes in a property tax assessment even after the deadline for appealing to an assessor or board of review has passed.

Read More -

February 11, 2019 Property Tax Insights

Mistakes happen. If a mistake occurs in the property tax process, it could be costly if not corrected. Fortunately, some errors are fixable -- even those that may have occurred in a previous year or years -- thanks to what is known as a Certificate of Error, or in property tax parlance, a C of E. When an assessment error is discovered, taxpayers can seek relief by filing a C of E with local assessing officials. However, be advised that the granting of a C of E by an assessing authority is discretionary, not mandatory.

Read More -

February 1, 2019 NewsCommercial & Business Litigation

The Illinois Condominium and Common Interest Community Ombudsperson Act (the “Act”), was enacted to “educate unit owners, condominium associations, common interest communities, boards of managers and boards of directors” on their respective rights and obligations as imposed by the governing documents, such as bylaws. In response to “anecdotal accounts of abuses” by Associations in handling enforcement of their covenants and restrictions, the stated goal of the Act is to avoid mistakes and misunderstandings in interpreting the documents, which are both costly and divisive to these kinds of communities.

Read More